Introduction

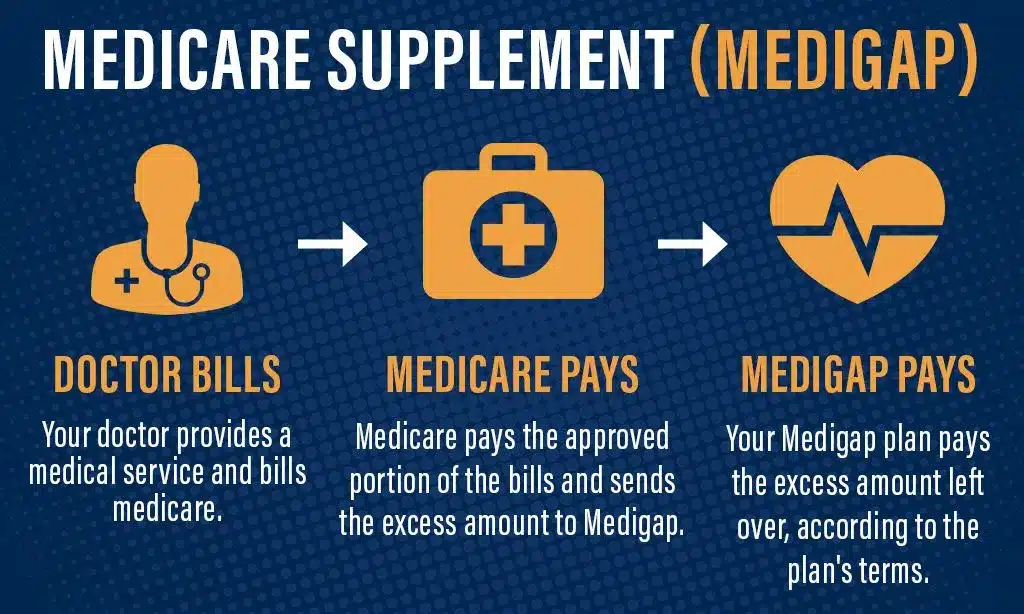

Which Medicare Supplement Plans Include Gym Membership: Medicare supplement plans, also known as Medigap plans, are designed to help fill the gaps in coverage that are not covered by Original Medicare. These plans are offered by private insurance companies and can provide additional benefits and services to Medicare beneficiaries. One popular benefit that some Medicare supplement plans include is a gym membership.

Gym memberships can be a valuable addition to a Medicare supplement plan, as they can help seniors stay active and maintain their overall health and well-being. Regular exercise has been shown to have numerous health benefits, including reducing the risk of chronic diseases, improving mental health, and increasing overall longevity. By including a gym membership in their Medicare supplement plan, seniors can have access to a variety of exercise equipment, fitness classes, and other resources that can help them stay active and achieve their health goals.

Not all Medicare supplement plans include a gym membership, so it is important for beneficiaries to carefully review the details of each plan before making a decision. Some plans may offer a gym membership as an additional benefit, while others may require an additional premium or co-payment for access to a gym. It is also important to note that not all gyms accept Medicare supplement plans, so beneficiaries should check with their preferred gym to ensure that they are eligible for coverage.

In addition to a gym membership, Medicare supplement plans can offer a range of other benefits and services. These can include coverage for prescription drugs, vision and dental care, hearing aids, and more. The specific benefits and coverage options will vary depending on the plan and insurance company, so it is important for beneficiaries to carefully review their options and choose a plan that best meets their individual needs and preferences.

Does Plan G pay for a gym membership?

Medicare Plan G is a popular Medicare Supplement plan that provides comprehensive coverage for hospital and medical costs when paired with Original Medicare. However, Plan G does not cover gym memberships, a common question among Medicare beneficiaries.

Medicare Supplement Plan G is a popular choice among Medicare beneficiaries due to its comprehensive coverage. However, when it comes to gym memberships, Plan G does not provide direct coverage. Plan G is designed to cover the gaps left by Original Medicare, which includes Part A and Part B. It covers expenses such as deductibles, copayments, and coinsurance, but it does not include coverage for additional services like gym memberships.

While Plan G does not directly pay for a gym membership, it does cover other important healthcare services. It covers the Part A deductible, which is the amount beneficiaries must pay before Medicare starts covering hospital expenses. It also covers the Part B coinsurance, which is the percentage of the Medicare-approved amount that beneficiaries are responsible for paying for outpatient services.

Although Plan G does not cover gym memberships, there are other Medicare plans that may provide this benefit. Some Medicare Advantage plans, also known as Medicare Part C, offer additional benefits beyond what Original Medicare covers. These plans are offered by private insurance companies and may include coverage for gym memberships, fitness classes, and other wellness programs.

It’s important to note that Medicare Advantage plans often have different rules and restrictions compared to Original Medicare and Medicare Supplement plans. They may have specific networks of providers and require beneficiaries to receive care from within those networks. Additionally, Medicare Advantage plans may have different costs, such as monthly premiums, deductibles, and copayments.

Does TRICARE cover gym memberships?

TRICARE is a healthcare program that provides coverage for military personnel, their families, and retirees. It offers a wide range of benefits, including medical, dental, and prescription drug coverage. However, when it comes to gym memberships, the coverage provided by TRICARE is not as straightforward.

TRICARE does not typically cover gym memberships as a standalone benefit. This means that if you are looking for coverage specifically for your gym membership, you may be out of luck. However, there are some exceptions to this rule.

One exception is the TRICARE Prime program. If you are enrolled in TRICARE Prime, you may be eligible for the TRICARE Prime Fitness Program. This program provides coverage for certain fitness and wellness services, including gym memberships. However, it is important to note that not all gym memberships are covered, and there may be certain restrictions and limitations.

Another exception is the TRICARE Extended Care Health Option (ECHO) program. This program provides coverage for certain services and treatments that are not covered by the regular TRICARE program. In some cases, gym memberships may be covered under the ECHO program if they are deemed medically necessary.

It is also worth noting that TRICARE may cover certain fitness and wellness programs that are offered by military installations. These programs are designed to promote health and wellness among military personnel and their families, and may include access to fitness centers and other wellness resources.

Is Medicare Part B a supplement?

Medicare Supplement (Medigap) Plan B is not the same as Medicare Part B, which is part of Original Medicare (along with Medicare Part A). Medigap Plan B serves to fill in the gaps in coverage left by Original Medicare, Part A and Part B.

Medicare Part B is not a supplement, but rather a component of the overall Medicare program. Medicare is a federal health insurance program that provides coverage for individuals who are 65 years or older, as well as certain younger individuals with disabilities. It is divided into different parts, with each part covering specific services and expenses.

Medicare Part B, also known as medical insurance, covers a wide range of services, including doctor visits, outpatient care, preventive services, and medical supplies. It is designed to help individuals pay for medically necessary services and supplies that are not covered by Medicare Part A, which primarily covers hospital stays and inpatient care.

While Medicare Part B provides important coverage for medical services, it is not a supplement. Medicare supplements, also known as Medigap plans, are private insurance policies that individuals can purchase to help cover the costs that Medicare does not pay for. These supplements are designed to fill in the gaps in coverage and help individuals pay for out-of-pocket expenses such as deductibles, copayments, and coinsurance.

Medicare Part B is a separate component of the Medicare program and is not considered a supplement. However, individuals who have Medicare Part B can choose to purchase a Medigap plan to help cover the costs that Medicare does not pay for. This can provide individuals with additional financial protection and help them better manage their healthcare expenses.

Medicare Part B is not a supplement, but rather a component of the overall Medicare program. It provides coverage for a wide range of medical services and supplies, but individuals may choose to purchase a Medigap plan to help cover the costs that Medicare does not pay for.

What supplement is best for Medicare?

Plan F, Plan G and Plan N are the most popular types of Medicare Supplement plans. Medicare Supplement Plan F is the most comprehensive Medigap option available, providing beneficiaries with 100% coverage of Medicare-covered medical expenses after Original Medicare pays its portion.

When it comes to choosing the best supplement for Medicare, there are several factors to consider. Medicare is a federal health insurance program for individuals who are 65 years or older, or for those who have certain disabilities. While Medicare covers a wide range of medical services, there are gaps in coverage that can leave beneficiaries with out-of-pocket expenses. This is where Medicare supplements, also known as Medigap plans, come in.

Medicare supplements are private insurance plans that help cover the costs that Medicare doesn’t. These plans are standardized and regulated by the government, which means that the benefits offered by each plan are the same, regardless of the insurance company you choose. However, the premiums and customer service may vary between insurance companies.

There are several different types of Medicare supplements to choose from, each offering different levels of coverage. The most popular plans are Plan F and Plan G. Plan F offers the most comprehensive coverage, paying for all Medicare-approved expenses that are not covered by Medicare. Plan G is similar to Plan F, but it does not cover the Medicare Part B deductible.

When deciding which supplement is best for Medicare, it’s important to consider your individual healthcare needs and budget. If you anticipate needing a lot of medical services and want the most comprehensive coverage, Plan F may be the best option for you. However, if you are looking for a more affordable option and are willing to pay the Part B deductible out-of-pocket, Plan G may be a better choice.

Ultimately, the best supplement for Medicare will depend on your specific circumstances and preferences. It’s important to carefully review the different plans and compare costs and benefits before making a decision. Consulting with a licensed insurance agent can also be helpful in navigating the options and finding the best supplement for your needs.

What is Plan F Medicare Supplement?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

Plan F Medicare Supplement is a type of Medicare Supplement Insurance, also known as Medigap, that provides coverage for certain out-of-pocket expenses that are not covered by Original Medicare. It is one of the most comprehensive Medigap plans available, offering a wide range of benefits to help fill the gaps in Medicare coverage.

Medicare Supplement plans, including Plan F, are sold by private insurance companies and are designed to work alongside Original Medicare. They help pay for costs such as deductibles, copayments, and coinsurance that Medicare beneficiaries would otherwise have to pay out of pocket. Plan F is often chosen by individuals who want the most comprehensive coverage available and are willing to pay a higher premium for it.

With Plan F, beneficiaries can enjoy coverage for Medicare Part A and Part B deductibles, as well as coinsurance and copayments for hospital stays, skilled nursing facility care, and doctor visits. It also covers the 20% coinsurance for Medicare-approved services that are not fully covered by Medicare. This means that beneficiaries with Plan F generally have little to no out-of-pocket costs for Medicare-covered services.

One important thing to note about Plan F is that it will no longer be available to new Medicare beneficiaries starting in 2020. This is due to changes in federal law that prohibit Medigap plans from covering the Part B deductible for new beneficiaries. However, individuals who already have Plan F will be able to keep their coverage and new beneficiaries who become eligible for Medicare before 2020 will still have the option to enroll in Plan F.

Overall, Plan F Medicare Supplement provides comprehensive coverage for out-of-pocket expenses that are not covered by Original Medicare. It offers peace of mind to beneficiaries by reducing or eliminating their out-of-pocket costs for Medicare-covered services. While it will no longer be available to new beneficiaries after 2020, it remains a popular choice for those who want the most extensive coverage available.

Medicare supplement plans, also known as Medigap plans, are designed to help cover the gaps in Original Medicare. There are several different types of Medicare supplement plans available, labeled with letters from A to N. Each plan offers a different combination of benefits, so it’s important to understand what each plan covers before making a decision.

Some of the most popular Medicare supplement plans include Plan F, Plan G, and Plan N. Plan F is the most comprehensive plan, covering all of the gaps in Original Medicare, including deductibles, copayments, and coinsurance. Plan G is similar to Plan F, but does not cover the Medicare Part B deductible. Plan N is a more cost-effective option, with lower premiums but some out-of-pocket costs.

It’s important to note that not all Medicare supplement plans are available in every state, and the availability of plans may vary depending on your location. It’s also worth considering that Medicare supplement plans do not cover prescription drugs, so you may need to enroll in a separate Medicare Part D plan for prescription drug coverage.

Do any Medicare supplement plans include gym membership benefits?

Yes, there are Medicare supplement plans that include gym membership benefits. These plans are known as Medicare Advantage plans, also referred to as Medicare Part C. Medicare Advantage plans are offered by private insurance companies approved by Medicare, and they provide all the benefits of Original Medicare (Part A and Part B) along with additional coverage, such as gym membership benefits.

Medicare Advantage plans that include gym membership benefits often have partnerships with fitness centers and gyms across the country. These plans may cover the cost of gym memberships, allowing beneficiaries to access fitness facilities and participate in various exercise programs at no additional cost. It’s important to note that not all Medicare Advantage plans offer gym membership benefits, so it’s essential to review the specific details of each plan to determine if this benefit is included.

How can I find out which Medicare supplement plans include gym membership?

When it comes to finding out which Medicare supplement plans include gym membership benefits, there are a few steps you can take to gather the necessary information. The first step is to review the plan documents provided by your Medicare supplement insurance provider. These documents will outline the specific benefits and coverage included in your plan. Look for any mention of gym membership benefits or wellness programs.

Additionally, you can contact your Medicare supplement insurance provider directly and inquire about gym membership benefits. They will be able to provide you with detailed information about the specific plans that include gym membership benefits and any requirements or restrictions associated with accessing these benefits.

Another helpful resource is the Medicare website. Visit the official Medicare website and navigate to the “”Find a Medicare plan”” section. From there, you can enter your zip code and search for Medicare supplement plans in your area. The search results will provide you with a list of available plans, and you can review the plan details to see if gym membership benefits are included.

Are there any specific requirements or restrictions for accessing gym membership benefits through Medicare supplement plans?

Yes, there are specific requirements and restrictions for accessing gym membership benefits through Medicare supplement plans. While some Medicare supplement plans may include gym membership benefits, not all plans offer this feature. It is important to carefully review the details of each plan to determine if gym membership benefits are included.

In addition, even if a Medicare supplement plan does offer gym membership benefits, there may be certain requirements that need to be met in order to access these benefits. For example, some plans may require you to enroll in a specific fitness program or meet certain health criteria before you can take advantage of the gym membership benefits.

Furthermore, there may be restrictions on the type of gym or fitness facility that is covered by the Medicare supplement plan. Some plans may only cover membership fees at specific gyms or fitness centers, while others may have a network of participating facilities that you must choose from. It is important to carefully review the plan’s terms and conditions to understand any limitations or restrictions that may apply.

Can you provide a list of Medicare supplement plans that offer gym membership benefits?

Yes, there are several Medicare supplement plans that offer gym membership benefits. These plans understand the importance of physical fitness and promote a healthy lifestyle for their members. Some of the popular Medicare supplement plans that include gym membership benefits are Plan F, Plan G, and Plan N.

Plan F: This plan offers the most comprehensive coverage and includes gym membership benefits. It covers all Medicare Part A and Part B deductibles, coinsurance, and copayments, as well as excess charges. With Plan F, you can enjoy the convenience of having access to a wide range of fitness facilities and classes.

Plan G: This plan is similar to Plan F but does not cover the Part B deductible. However, it still includes gym membership benefits, allowing you to stay active and maintain your fitness goals. Plan G is a popular choice among Medicare beneficiaries who want comprehensive coverage without the higher premium of Plan F.

Conclusion

There are several Medicare supplement plans that include gym membership as a benefit. These plans recognize the importance of physical fitness and offer additional incentives to encourage seniors to stay active and healthy. By including gym memberships, these plans provide seniors with access to a wide range of exercise equipment, classes, and facilities that can help them maintain their overall well-being.

One of the Medicare supplement plans that include gym membership is Plan F. This comprehensive plan covers a wide range of medical expenses and also includes a gym membership as part of its benefits package. This allows seniors to take advantage of the various fitness programs and facilities offered by participating gyms, helping them stay fit and active.

Another plan that includes gym membership is Plan G. This plan offers similar coverage to Plan F but with a slightly lower premium. In addition to its comprehensive coverage, Plan G also provides seniors with a gym membership, giving them the opportunity to engage in regular exercise and improve their physical health.

Lastly, Plan N is another Medicare supplement plan that includes a gym membership. This plan offers a more cost-effective option for seniors while still providing them with access to a gym. With Plan N, seniors can enjoy the benefits of regular exercise without breaking the bank.

Medicare supplement plans that include gym membership are a great option for seniors who want to prioritize their physical fitness. These plans not only provide comprehensive medical coverage but also recognize the importance of regular exercise in maintaining overall health. By including gym memberships, these plans offer seniors the opportunity to stay active, engage in various fitness activities, and improve their well-being.

4 comments

… [Trackback]

[…] Find More to that Topic: thefitnessblogger.com/which-medicare-supplement-plans-include-gym-membership/ […]

… [Trackback]

[…] Here you can find 49589 additional Info on that Topic: thefitnessblogger.com/which-medicare-supplement-plans-include-gym-membership/ […]

… [Trackback]

[…] Find More Info here on that Topic: thefitnessblogger.com/which-medicare-supplement-plans-include-gym-membership/ […]

… [Trackback]

[…] Read More here on that Topic: thefitnessblogger.com/which-medicare-supplement-plans-include-gym-membership/ […]